Grey Market Share.com offer stocks that are yet not listed to Investors (Angel, Accredited Investors, VC, AIF and PE Funds) so that the exchange of hands can become easy in unlisted companies. It aims to solve the problem of the availability of IPO stocks to investors with its flagship product PreIPO. Startups and Private companies can raise funds on our platform.

Grey Market Share offer upcoming IPO stocks to our investor so our investor can buy stocks before the IPO. We also provide proper information of company to our client also we provide upcoming IPO, unlisted and delisted shares.

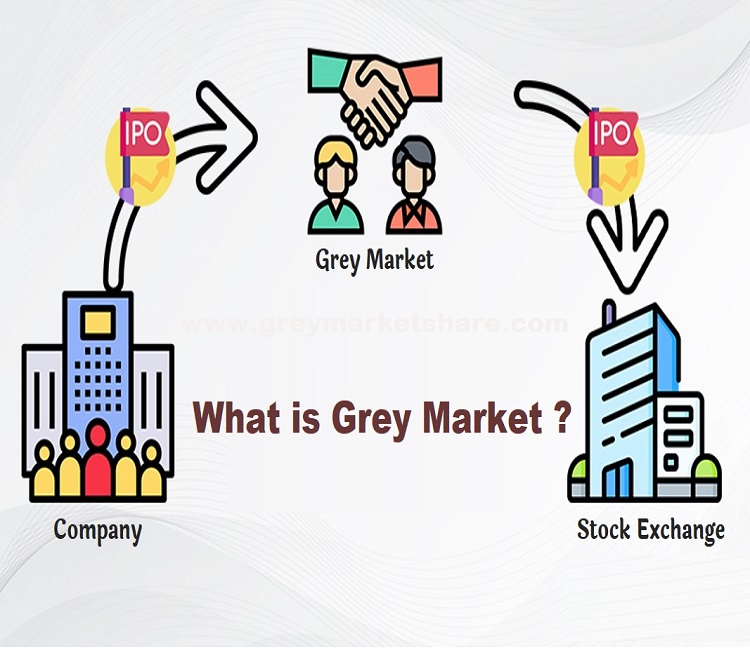

Grey Market stock can be explained as a market that works parallelly with the stock market. However, the traders deal with unofficial dealers in the market.

The grey stock market in India is legal and unofficial. Only the mutual trust between the traders is considered while trading in the grey market stock. In simple terms, it is a risky way of investment that leads to high returns. Major products traded in the market includes luxury products like bags. Some grey market stocks are issued by spin-off and various start-ups like Zomato to analyse and understand the market before getting listed on SEBI. Grey market IPO also works in the market. However, it is not an official market of IPO market. The SEBI regulation does not promote raising funds through the Grey IPO market. Interestingly many companies are trading in grey market IPO and in return providing, the grey market premium which is earned over IPO bought and sold outside the stock market.

© 2011-2025 Grey Market Share. All Rights Reserved by Grey Market Share.com